In the bustling city of Dallas, where a vast network of highways and streets interconnect, motor vehicles are an indispensable part of daily life. With a population that continues to grow rapidly and a thriving economy, the number of drivers on Dallas roads has surged over the years. Unfortunately, along with the increased vehicular activity comes an uptick in accidents and traffic violations, leading to a significant demand for SR-22 insurance.

SR-22 insurance, also known as a Certificate of Financial Responsibility (CFR), is a unique form of auto insurance that is required for individuals deemed “high-risk” by the state authorities. It serves as proof that drivers are financially responsible for any damages they may cause while operating a vehicle. Though not an insurance policy itself, the SR-22 is a critical document that ensures compliance with state regulations, enabling high-risk drivers to regain their driving privileges after facing certain violations or accidents.

SR-22 insurance, also known as a Certificate of Financial Responsibility (CFR), is a unique form of auto insurance that is required for individuals deemed “high-risk” by the state authorities. It serves as proof that drivers are financially responsible for any damages they may cause while operating a vehicle. Though not an insurance policy itself, the SR-22 is a critical document that ensures compliance with state regulations, enabling high-risk drivers to regain their driving privileges after facing certain violations or accidents.

The need for SR-22 insurance in Dallas has witnessed a notable surge in recent years, with data indicating a marked increase in traffic incidents and violations. The Texas Department of Transportation reported an alarming rise of 67% in at-fault accidents and traffic citations in Dallas County alone during the past two years. Consequently, the number of drivers categorized as high-risk by the Texas Department of Motor Vehicles (TxDOT) has reached an all-time high, necessitating a comprehensive understanding of SR-22 insurance and its implications.

As the state authorities continue to tighten regulations to ensure road safety, the demand for SR-22 insurance providers has also expanded exponentially. Insurance companies have responded to this trend, offering tailored SR-22 policies to cater to the unique needs of high-risk drivers. This increase in competition has led to varying rates and coverage options, making it imperative for Dallas residents to stay informed about the best options available to them.

What is SR-22 insurance, and why is it required in Dallas, TX?

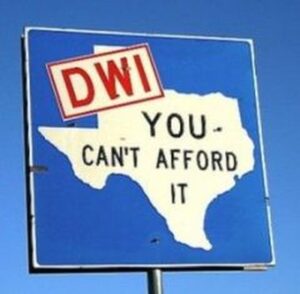

SR-22 insurance is not a policy itself but a certificate of financial responsibility filed by your insurance provider on your behalf with the Texas Department of Motor Vehicles (TxDOT). It is required for high-risk drivers who have committed serious traffic violations, such as DUI/DWI, reckless driving, or driving without insurance. The SR-22 filing serves as proof that you have the necessary auto insurance coverage to be financially responsible in case of an accident or further violations.

Who needs SR-22 insurance in Dallas?

Drivers who have been involved in severe traffic incidents, accumulated excessive points on their driving record, had their license suspended, or were caught driving without insurance may be required to carry SR-22 insurance in Dallas, TX.

How long is an SR-22 filing required in Dallas, TX?

The duration of an SR-22 filing varies depending on the offense and state requirements. In Dallas, TX, it typically ranges from 1 to 3 years, but specific details will be provided by the Texas DMV.

Can I obtain an SR-22 form from any insurance company, or are there specific providers for high-risk coverage in Dallas?

Not all insurance companies offer SR-22 filings, as it is associated with higher risk. However, some insurers specialize in providing coverage for high-risk drivers in Dallas. It’s essential to shop around and find an insurance company that offers SR-22 filings in the state of Texas.

How do I know if I need SR-22 insurance after a traffic violation or accident in Dallas?

If you have been convicted of certain serious traffic violations or have had your license suspended, the Texas DMV will notify you about the requirement for an SR-22 filing. You can also check with your local DMV office or contact your insurance provider to determine if you need SR-22 insurance.

Will an SR-22 filing affect my insurance rates in Dallas, TX?

Yes, an SR-22 filing is generally associated with higher insurance rates. High-risk drivers are considered more likely to be involved in accidents, so insurance companies typically charge higher premiums for SR-22 coverage.

Can I get a non-owner SR-22 policy if I don’t own a vehicle but still need coverage?

Yes, if you don’t own a vehicle but still need to maintain SR-22 insurance in Dallas, you can get a non-owner SR-22 policy. This type of policy provides coverage when you drive someone else’s vehicle.

What happens if I let my SR-22 insurance policy lapse in Dallas?

If your SR-22 insurance policy lapses or is canceled, your insurance provider will notify the Texas DMV, which may result in the suspension of your driving privileges until you reinstate the SR-22 policy.

How quickly can I get an SR-22 filing in Dallas, TX, and what is the process involved?

The process of obtaining an SR-22 filing can vary depending on the insurance company. Some may offer immediate filings, while others may take a few business days. Contact your insurance provider to understand their specific process for SR-22 filings in Dallas, TX.

Can I transfer my SR-22 insurance from another state to Dallas, TX?

If you move from another state to Dallas, TX, you’ll likely need to refile your SR-22 with the Texas DMV to comply with state requirements. Your insurance provider can assist you with the necessary steps for transferring your SR-22 coverage.

Remember, SR-22 insurance is a complex topic, and it’s crucial to consult with a knowledgeable insurance agent or the Texas Department of Motor Vehicles to ensure you meet all the necessary requirements in Dallas, TX.

License Suspended

If you are charged of the DWI and had your license suspended by the state of Texas for this offense then you would now be required to get and carry SR-22 insurance as part of your driver’s license reinstate-ment process.

If you are charged of the DWI and had your license suspended by the state of Texas for this offense then you would now be required to get and carry SR-22 insurance as part of your driver’s license reinstate-ment process.

The Texas Department of Public Safety (DPS) states that a conviction for driving while intoxicated (DWI) will typically results in a license suspension or revocation, which this time period will vary depending on the court but should not exceed two years. A conviction of a DWI for a driver who is under the age of 21, according to the Texas Transportation Code 521.344 that driver will have an automatic drivers license suspension for a year per.

Filing an SR22 Certificate

The filing requirement is due to a traffic violation. If you fail to comply with your requirement, the state will suspend your license and vehicle registration.

The most common violation that requires SR22 insurance are: DWI’s DUI and Tickets for Driving Without Financial Responsibility or ” no Insurance “. The SR22 form is issued by an appropriately licensed car insurance company.

In Dallas, Texas, the minimum liability insurance coverage is 30/60/25. An SR-22 form simply guarantees the DMV that the insured party has the required liability insurance required. Generally the problem driver will need to carry a SR22 insurance for a period of 2 years.

Getting Free Quotes

After getting an insurance, you will need to keep it active or else your license will be suspended as well as your driving privileges. You might also face jail time and thousands of dollars in fines. It is easy to find SR-22 insurance quotes but keep in mind that you are now considered to be a high risk. Most car insurance companies are alarmed when a policyholder is required to obtain an SR22. Sometimes they do not offer renewal for these policyholders. Also, not all car insurance companies offer an SR22 insurance.

But do not worry. There are still many car insurance companies out there that are willing to insure you. The best thing to do is to compare insurance quotes to make sure you are getting the best deal. It may not be as cheap as the standard car insurance before your infraction, but still you have other options to make your car insurance low.